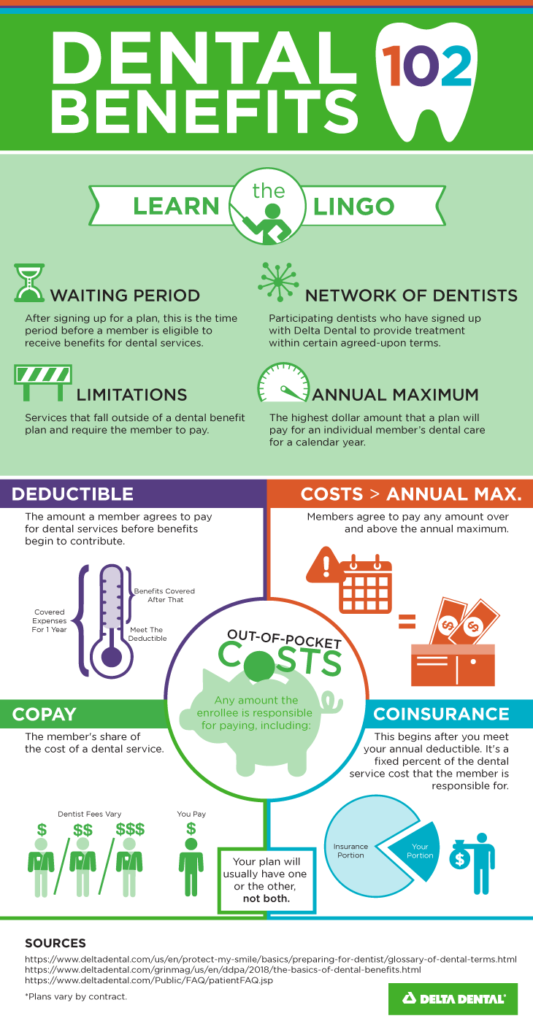

A dental insurance deductible is the amount you must pay before your dental plan

begins to pay for approved dental services.

Once every 12 months, your deductible amount is reset. Many dental insurance

companies adhere to the calendar year (e.g.; January through December). Confirm the

specific dates with your dental plan provider.

Annual dental insurance deductibles are divided into two categories:

At the individual level, a deductible is a certain amount that must be paid each year.

At the family level, there is a yearly deductible.

Individual

Your deductible will be applied first when your dentist submits a claim for a treatment,

and then your coinsurance will be calculated. For example, let’s say you get a $250

dental service reimbursed by your insurance. This service is covered by your plan to the

tune of 80%. If you have not yet paid your deductible for the year, you will be required to

pay a $50 deductible before getting coverage, which will be applied to the charges for

your dental treatments.

When your dentist submits a claim for a treatment, your deductible will be charged first,

followed by your coinsurance. As an example, let’s imagine your insurance reimburses

you $250 for a dental service. This service is covered to the tune of 80% by your plan. If

your deductible for the year has not been met, you will be forced to pay a $50

deductible before receiving coverage, which will be added to the costs of your dental

procedures.

Annual deductible for a family

In a family plan, you’ll have a family deductible, as well as an individual deductible for

each family member that feeds into the family deductible. So, if you have a $200 family

deductible and a family of five, your family deductible will be covered once four $50

individual deductibles have been paid.